Two Chinese copper smelters have announced plans to reduce production next year due to diminishing profit margins caused by an ongoing shortage of ore concentrate, Bloomberg reported on Tuesday (July 16).

These decisions were revealed during a quarterly meeting of Chinese smelters held in Shanghai last week.

Daye Nonferrous Metals, a major smelter based in the country’s Hubei province, plans to cut its smelting output by 20 percent in 2025. The company has already implemented smaller reductions, resulting in a decline in its total refined copper production capacity, which now stands at 930,000 metric tons on an annual basis.

Baotou Huading Copper Industry Development, a smaller firm with an annual capacity of 200,000 metric tons of blister and 30,000 metric tons of refined copper, plans to cut its smelting output by 40 percent next year. According to Bloomberg, the company already reduced its output by 20 percent last month due to a concentrate shortage.

The imbalance between mine supply and smelting capacity has been squeezing the profit margins of smelters. This situation has been exacerbated by the continuous expansion of smelting facilities across Asia.

Processing fees, known as treatment charges, have collapsed to near zero in the spot market. Most smelters are able to get the majority of their supply at better annual terms, but these terms may also be set to drop sharply.

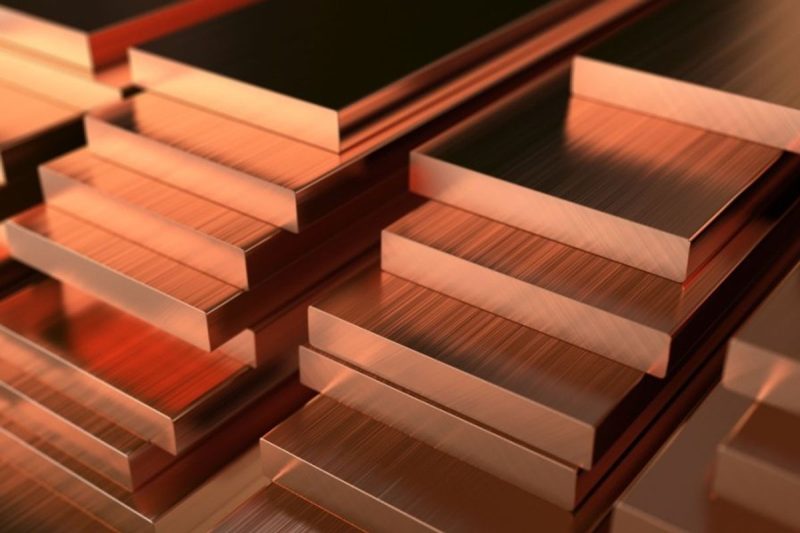

These factors have contributed to bullish market sentiment, driving copper to record highs earlier this year. The red metal hit its highest recorded price of US$5.20 per pound, or US$11,464 per metric ton, on May 20 of this year. This move is part of a long-term upward trend, with prices having increased over 500 percent since January 2000.

In addition to production challenges, the global copper market is experiencing shifts in demand patterns.

The State Grid Corporation of China, the world’s largest buyer of copper, has slowed its purchases of copper wire this year and increased its purchases of aluminum wire, a cheaper substitute.

However, some traders and industry executives believe the substitution of copper with aluminum is a temporary response to high prices rather than a permanent shift.

Securities Disclosure: I, Giann Liguid, hold no direct investment interest in any company mentioned in this article.