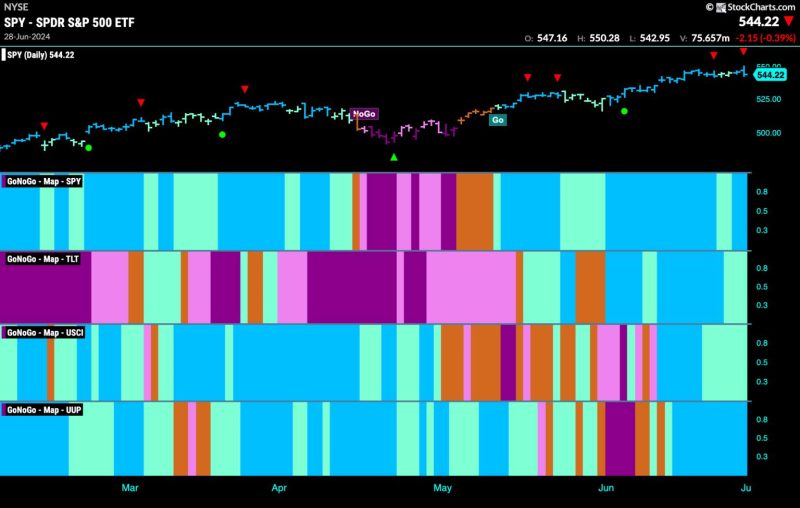

Good morning and welcome to this week’s Flight Path. “Go” bars were the order of the week again for U.S. equities and the end of the week saw a return to strong blue bars. Treasury bond prices also were able to maintain “Go” bars but ended the week showing weakness. U.S. commodity index painted a full week of weaker aqua “Go” bars while the dollar continued to show strength with strong blue bars.

$SPY Remains in “Go” Trend but Struggles with New Highs

Price hit an intra week high again this week but we saw Friday close lower. GoNoGo Trend painted strong blue bars at the end of the week and so we know the trend remains strong. GoNoGo Oscillator has fallen from overbought territory and volume is light as it crashes toward the zero line. So, we have momentum waning but price holding on to trend. We will watch to see what happens as the oscillator gets to zero and we will look for it to find support if the trend is to remain healthy.

Price crept higher this week and we saw another strong blue “Go” bar which makes it 8 in a row. GoNoGo Oscillator has peaked but is still overbought at a value of 5. We will look to see if momentum continues to wane and if so we’ll see a Go Countertrend Correction Icon (red arrow) that will indicate a likely pause and a struggle for prices to go higher in the short term.

Treasury Rates Still in “NoGo” Trend but Paints Weaker Pink Bars

Treasury rates climbed this week after last week’s low and we see that GoNoGo Trend paints a few weaker pink bars. The weight of the evidence still points to a “NoGo” trend but we will watch to see if it holds this week. GoNoGo Oscillator has rallied and is testing the zero level from below. If it is rejected here, we will likely see a new leg down in price.

Dollar Sees Continued Strength as Price Makes New Highs

Price hit new highs this week and GoNoGo Trend painted a week of uninterrupted strong blue “Go” bars. We will look for price to consolidate at these levels using support from prior highs in May. GoNoGo Oscillator has flatlined at a value of 3 and so is in positive territory but not yet overbought. Volume is heavy.